You can learn more about the knowledge and FAQ related to the law.

You can ask the lawyer about your case directly.

Online consultation and handling save you time and energy.

Swift turnaround, you need not wait in a queue to meet your lawyer!

Both wills and trusts are important estate planning vehicles. Estate planning is one of the most important steps any person can take to make sure that their final property and health care wishes are honored, and that loved ones are provided for in their absence. The purpose of estate planning is to have your affairs handled according to your wishes, minimize taxes your estate should pay, and to avoid probate.

Wills are the most basic estate planning tool. You can use a will to designate the distribution of your property, and name guardians for your minor children and an adult called executor to handle your estate after your death.

Trusts are a kind of artificial legal entity that can hold property. The trustor executes a trust document, transfer some property into the trust, and designate trustees and beneficiaries. The trustees manage the trust and distribute the trust property to beneficiaries according to the trust document. Trust property can avoid probate, so many people choose trusts when they make their estate planning. The most common kinds of trusts are living trust and testamentary trust.

Probate is the process by which legal title of property is transferred from the decedent's estate to his/her beneficiaries. Since you can't take it with you, the court determines who gets it.

If a person dies with a Will ("testate"), the probate court determines if the Will is valid, hears any objections to the Will, orders that creditors be paid and supervises the process to assure that property remaining is distributed in accordance with the terms and conditions of the Will.

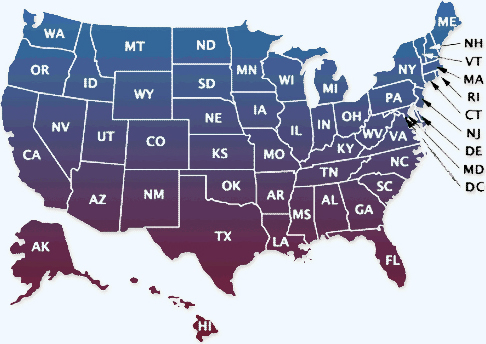

If a person dies without a Will ("intestate"), the probate court appoints a person to receive all claims against the estate, pay creditors and then distribute all remaining property in accordance with the laws of the state. The major difference between dying testate and dying intestate is that an intestate estate is distributed to beneficiaries in accordance with the distribution plan established by state law; a testate estate (after payment of debts, taxes and costs of administration) is distributed in accordance with the instructions provided by the decedent in his/her Will.